Use your rich customer data to build lifetime value and customer trust by creating highly personalized messages, recommendations, and content.

- Lead Nurturing: Keep customers engaged throughout their lifetime with relevant educational content and offers.

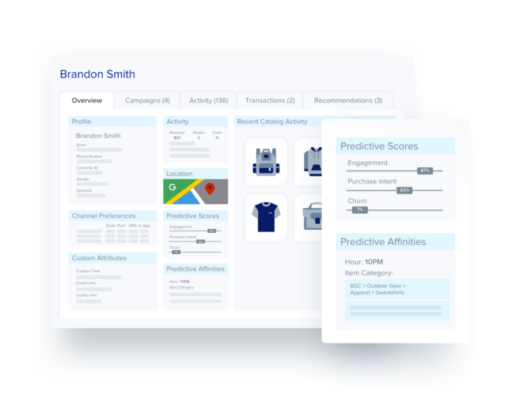

- Lead Generation: Listen and act on indicators of when customers are ready to respond to an offer or at risk of churn.

- Upsell and Cross-Sell: Enrich customers’ financial wellbeing by using predictive recommendations to new offers.

- Integrated Engagement: Engage with members on the channels where they want to interact with you, online or offline.