Become a Trusted Advisor Beyond the Transaction

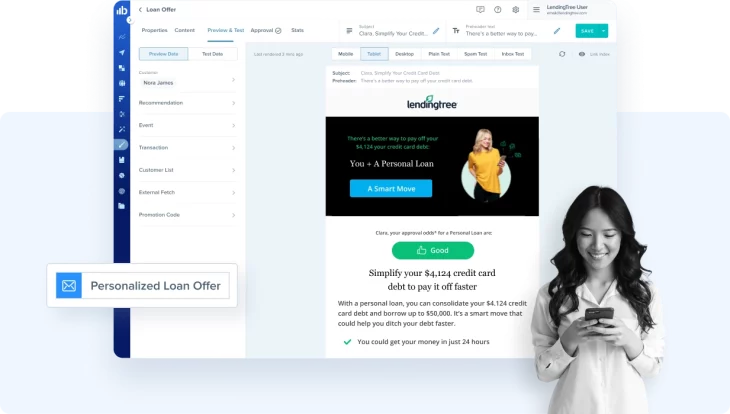

To make the strategic switch, the team had to disassemble their existing customer engagement strategy without affecting any active campaigns. With the visibility that Blueshift provides into each stage of the customer journey, the LendingTree team was able to get closer to the customer by understanding the distinct behaviors of their numerous segments. They used this insight to create intentional, connected journeys and target their campaigns more effectively — ultimately allowing them to better serve their customers.

Take the Customer-First Approach to the Next Level

The team began by auditing all communications through the lens of the customer and thought, “What should we be doing for the customer, and what does the customer expect from us?” They identified where customers needed guidance, where they could help customers find what they’re looking for faster, and where there was an opportunity to cross-sell. This process allowed them to redefine new buying paths and create intuitive journeys for each type of customer.