- AI-Powered Personalization: Leverage real-time data to deliver relevant financial offers, product recommendations, and messaging.

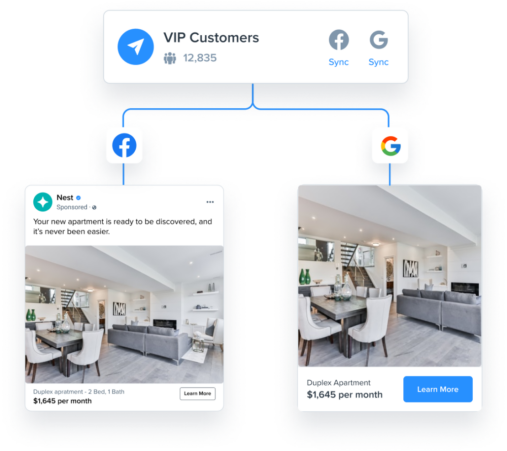

- Omnichannel Engagement: Seamlessly connect with customers across email, mobile, web, and more—at the most optimal times.

- Predictive Intelligence: Anticipate customer needs and deliver tailored solutions, reducing churn and increasing engagement.

- Automation & Compliance: Automate marketing workflows while maintaining full compliance with financial regulations and data security standards.

AI-POWERED FINANCE MARKETING

Federal Savings Bank + Blueshift:

A Smarter Approach to Customer Engagement

At Federal Savings Bank, delivering exceptional customer experiences is a top priority. Blueshift empowers you to engage customers with personalized, data-driven marketing that enhances loyalty, increases conversions, and strengthens customer relationships.

Why Blueshift for Federal Savings Bank?

Personalized Solutions for Federal Savings Bank

- AI-Driven Customer Journeys – Automatically create and optimize personalized banking experiences.

- Dynamic Content & Offers – Deliver the right financial products at the right time.

- Secure & Scalable Platform – Built for financial institutions, ensuring data security and compliance.

Drive Growth With Hyper-Relevant Financial Touchpoints

- Personalized Recommendations: Recommend the right content or product exactly when your customer needs it based on AI-driven analysis of spending patterns.

- Real-Time Messaging: Congratulate customers for hitting financial milestones like improved credit scores and offer tips for further growth.

- Reactivating Dormant Accounts: Identify and reconnect with inactive customers by offering personalized financial information and solutions based on their unique history.

Top Financial Brands Trust Blueshift to Drive Engagement and Growth

Customer Success Story

Clearscore Makes Messaging 10 Million Users Feel Personal

Clearscore leverages Blueshift to run hyper-personalized customer journeys to over 10 million users globally. With Blueshift, Clearscore is able to build better integrated, better targeted cross-channel messages, making 40 million messages a month feel personal by delivering dynamic content relevant to each unique user.

Customer Success Story

LendingTree Grows Customer Engagement with Intentional Journeys

LendingTree uses Blueshift to make it easier for customers to find the right loan through its loan marketplace. Its marketing team uses rich customer data gathered from the Blueshift platform to create connected customer journeys for more effective campaign targeting across channels. The result is a 17% lift in monthly active users, and a 48% increase in open rates.

Customer Success Story

Ent Credit Union Achieves 32% Increase in Member Engagement with Unified, Actionable Data

Ent Credit Union teams up with Blueshift to unify their rich member data from all sources, enabling efficient cross-channel marketing and scalable personalized member engagement. With actionable data readily available to marketers, Ent Credit Union has launched 155 workflows, mapped over 200 data points, achieved a 32% increase in overall member engagement, and saved 25+ hours on segmentation.

Customer Success Story

Suncoast Transforms Digital Member Engagement with Data-Driven Personalization

Suncoast Credit Union partnered with Blueshift to transform their digital member engagement through data-driven personalization and automation. By delivering personalized experiences guided by real-time member behavior, Suncoast has been able to improve member experiences and reduce campaign workload, including a 4x increase in engagement with their onboarding message.

COMPLIANCE AND SECURITY

Stay Compliant and Secure with Blueshift’s Advanced Data Protection

Innovation thrives in a secure environment. Blueshift takes pride in keeping your data secure, adhering to the highest compliance standards. Simplify compliance with Fair Lending Laws and other stringent regulations by enabling easy blacklisting of specific attributes from targeting, and more.

GET IN TOUCH

Your Blueshift Partner

Hope this curated selection of content was helpful! I’m excited to partner with Federal Savings Bank to drive smarter customer engagement with Blueshift’s AI-powered platform. Let’s connect to explore how we can optimize your marketing strategies and maximize results!